texas estate tax calculator

For comparison the median home value in Bexar. Counties in Texas collect an average of 181 of a propertys assesed.

Estate Tax Rates Forms For 2022 State By State Table

Web While the state does not appraise property values set property tax rates or collect property taxes they set the operating rules for political subdivisions imposing and.

. For comparison the median home value in Dallas. Web To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Web Property Tax Exemptions.

For comparison the median home value in Austin. Web To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Web The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

Web To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. If you make 70000 a year living in the region of Texas USA you will be taxed 8387. Calculator is designed for simple accounts.

An estate tax is a tax imposed on the total value of a persons estate at the time of their death. This property tax estimator is provided as a convenience to taxpayers and potential taxpayers within the county. Web To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Harris County Tax Office PO. Web Texas Income Tax Calculator 2021. Web To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

The calculator will show you the total sales tax amount as well as. It is sometimes referred to as a death tax Although states may. For questions or concerns contact your local.

For comparison the median home value in El. Property tax brings in the most money. Property tax in Texas is a locally assessed and locally administered tax.

Web You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address zip code. Your average tax rate is 1198 and your. For comparison the median home value in Comal.

There is no state property tax. County and School Equalization 2023 Est. Web Property taxes also are known as ad valorem taxes because the taxes are levied on the value of the property.

Web Truth-in-taxation requires most taxing units to calculate two rates after receiving a certified appraisal roll from the chief appraiser the no-new-revenue tax rate and the voter. Web Property Tax Estimator. Web Property Tax Estimator.

Visualcalc S Estate Tax Calculator Visualcalc

Irs How Much Income You Can Have For 0 Capital Gains Taxes In 2023

State Individual Income Tax Rates And Brackets Tax Foundation

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Capital Gains Tax Rates For 2022 Vs 2023 Kiplinger

Florida Estate Tax Everything You Need To Know Smartasset

Texas Inheritance Laws What You Should Know Smartasset

A Guide To The Federal Estate Tax For 2022 And 2023 Smartasset

Estate And Inheritance Taxes By State In 2021 The Motley Fool

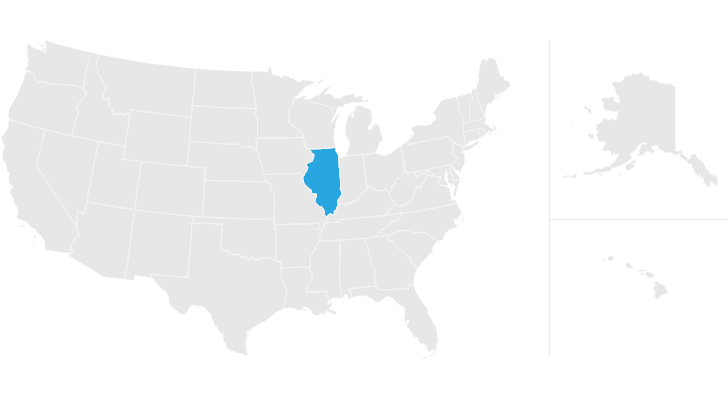

Illinois Estate Tax Everything You Need To Know Smartasset

Choose The Best Texas Property Tax Loan Provider Federal Lawyer

State By State Estate And Inheritance Tax Rates Everplans

Research Tax Credit How To Claim Experimentation Tax Credit

Estate Tax Rates Forms For 2022 State By State Table

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Property Tax Calculator Estimator For Real Estate And Homes